Petty Cash Creating, Disbursement, Replenishing, Journal Entry

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

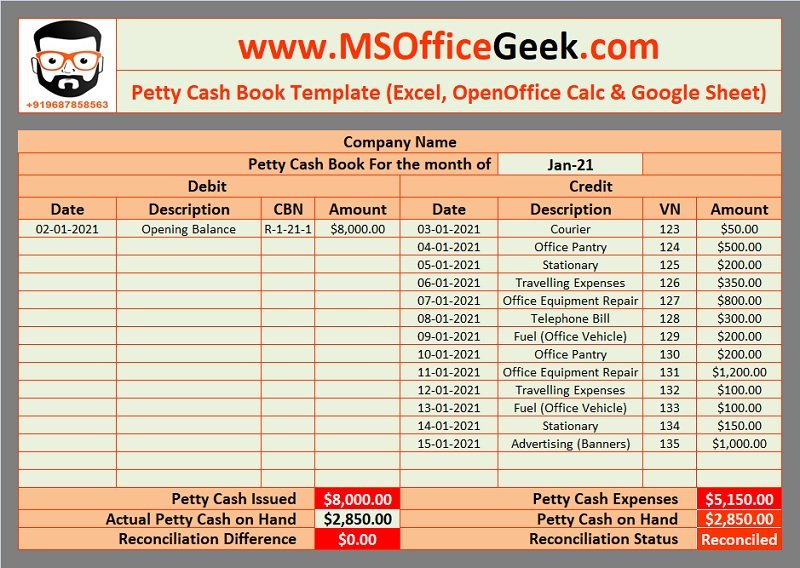

Simple Petty Cash Book

Petty cash books are prepared using the ordinary system and imprest system. If you use accrual accounting, the top-up may be credited from accounts payable instead of cash. The next step is to write a check to petty cash for $200, cash it, and stow it in your cash register or lockbox. Without a physical, dedicated place to keep the petty cash, you’ll probably lose track of it, and/or make so many exceptions to when you use the petty cash that it stops being useful.

Cash Book vs. Cash Account

For businesses committed to strategic financial planning, a granular analysis of expenses is indispensable. The petty cash book, with its detailed records, serves as a valuable tool for dissecting small-scale transactions. Establishing a culture of accountability is pivotal in reducing fraud risks. With a dedicated record of petty cash transactions, businesses can effortlessly reconcile their accounts. This helps in minimizing discrepancies and enhancing the accuracy of financial reports during audits or assessments.

Posting petty cash book to ledger

- Each petty cash expense has a separate column, and the totals of each expense are calculated automatically.

- In addition, the chief cashier in a large business is required to handle numerous large transactions on a daily basis.

- Using a petty cash book is critical to ensuring that petty cash is sufficient and properly spent.

With QuickBooks cloud accounting software, you’ll not only be able to access your financial information on the go, but you’ll also be able to save time and cost and ensure data security. Sometimes, the balance in your petty cash fund becomes too low to purchase small expenses. In these cases, the custodian should tally and summarise the receipts. These receipts can be exchanged for a new check made to cash the total amount equal to the receipt. Once the check is cashed, this amount will be added to the petty cash fund to restore the funds to its original level. The petty cash custodian is the person accountable for the petty cash fund.

practical tips to maximize petty cash management

Include the petty cash transactions in regular financial reports, ensuring that all expenditures are accounted for in the overall financial records of the business. Business organizations have various day-to-day expenses like office material expenses, postal stamps, conveyance, etc., where payment by cheque is not possible. The companies have widely adopted Imprest Petty Cash System to run their petty cash account. Under the petty cash Imprest System, the petty cashier amount is fixed for a given period, usually a month or a week. Under this period, the cashier must run the petty cash account under the given budget.

It is also much faster to access cash information in a cash book than by following the cash through a ledger. Harness technology to enable real-time monitoring of petty cash expenses. If every employee has access to petty cash, bad or nonexistent record keeping usually results. Instead, designate one employee to be responsible for the petty cash fund. When the petty cash fund is low, the custodian requests reimbursement from the main cash or bank account.

Processing small transactions through a company’s main accounting system can be time-consuming and costly. Not suitable for managing larger expenses, as it is designed for small, routine transactions. Larger transactions are typically handled through formal accounting channels. Collect and attach receipts or vouchers for every expense to maintain proper documentation and ensure transparency.

Further, account reconciliation involves resolving any discrepancies that may have been discovered. A noteworthy benefit of maintaining petty cash books is the streamlined reconciliation process. Missing data can be a pain for the finance team as they won’t be able to log those entries in the accounting system.

As you optimize your financial processes, consider how alternative financing solutions can further enhance your business’s financial flexibility. This example illustrates how a small fund can facilitate quick, necessary purchases throughout the day without disrupting workflow or requiring complex approval processes. While petty cash can reduce some administrative tasks, it also creates what is an audit everything about the 3 types of audits new ones. It can streamline your financial processes and save valuable time and resources when managed correctly. It’s not just about having a few dollars on hand; it’s about creating a system that balances convenience with accountability. If you’ve received a good or service and plan to pay for it in the future, you have to record it in your books as an accrued expense.