Closing Entries Definition, Examples, and Recording

Since QuickBooks automates the year-end close, you don’t have to get caught up with all of these manual entries unless something was to go wrong. Even then you can get a bit of help or an accountant to sort you out. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The articles and research support materials available on this site are educational what is the main focus of managerial accounting and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

Get in Touch With a Financial Advisor

Lastly, if we’re dealing with a company that distributes dividends, we have to transfer these dividends directly to retained earnings. Notice that the balance of the Income Summary account is actually the net income for the period. Remember that net income is equal to all income minus all expenses. If you’re getting a little woozy thinking about how to stay on top of all these month-end tasks or you’re already struggling to keep up, then it makes sense to invest in a financial close tool.

Centralize Data

Closing entries, on the other hand, are entries that close temporary ledger accounts and transfer their balances to permanent accounts. Closing all temporary accounts to the income summary account leaves an audit trail for accountants to follow. The total of the income summary account after the all temporary accounts have been close should be equal to the net income for the period. At the end of the year, all the temporary accounts must be closed or reset, so the beginning of the following year will have a clean balance to start with. In other words, revenue, expense, and withdrawal accounts always have a zero balance at the start of the year because they are always closed at the end of the previous year.

What are Temporary Accounts?

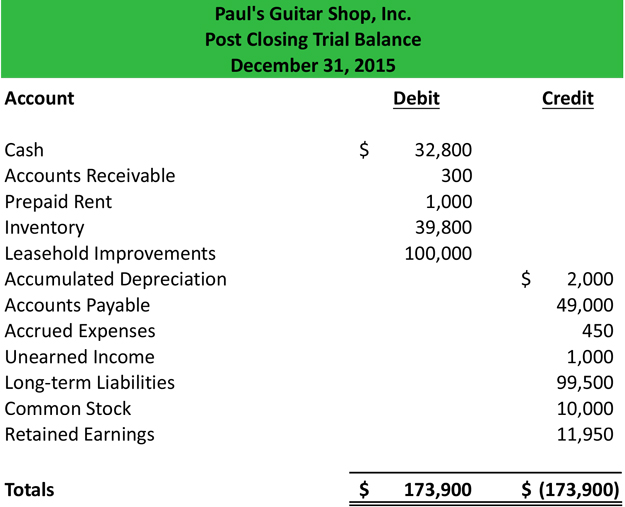

Lastly, prepare a post-closing trial balance to verify that the balances of the permanent accounts are correct and that the temporary accounts have been reset to zero. Closing entries are those journal entries made in a manual accounting system at the end of an accounting period to shift the balances in temporary accounts to permanent accounts. This is a necessary part of the closing process that occurs at the end of each reporting period. There may be a scenario where a business’s revenues are greater than its expenses.

Closing entries are performed after adjusting entries in the accounting cycle. Adjusting entries ensures that revenues and expenses are appropriately recognized in the correct accounting period. Once adjusting entries have been made, closing entries are used to reset temporary accounts. One account you’ll want to be aware of when performing closing entries is the income summary account. The income summary account is a temporary account that you put all revenue and expense accounts into at the end of the accounting period.

Everything to Run Your Business

- ‘Retained earnings‘ account is credited to record the closing entry for income summary.

- After these entries, all temporary accounts (revenue, expenses, dividends) will have zero balances, and the net income and dividends will be reflected in the Retained Earnings account.

- The income summary account must be credited and retained earnings reduced through a debit in the event of a loss for the period.

- To close the drawing account to the capital account, we credit the drawing account and debit the capital account.

One of your responsibilities is creating closing entries at the end of each accounting period. Balances of permanent accounts are carried forward to the subsequent accounting period. As an another example, you should shift any balance in the dividends paid account to the retained earnings account, which reduces the balance in the retained earnings account. The $10,000 of revenue generated through the accounting period will be shifted to the income summary account.

After most of the cycle is completed and financial statements are generated, there’s one last step in the process known as closing your books. Remember that all revenue, sales, income, and gain accounts are closed in this entry. As you will see later, Income Summary is eventually closed to capital. Educate team members about the closing process while also encouraging them to learn from each cycle. Share insights and tips within the team to foster a culture of ongoing improvement. Regular training sessions ensure everyone is on the same page and can adapt to any process changes or new software tools.

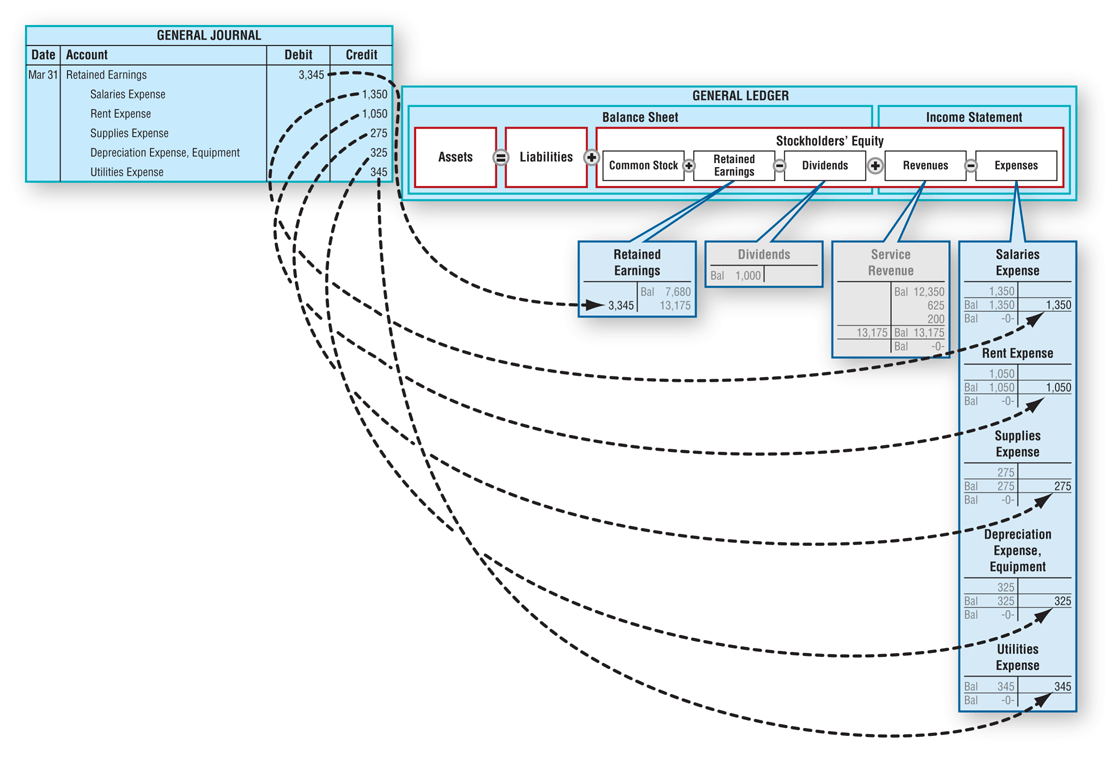

We do not need to show accounts with zero balances on the trial balances. Accountants may perform the closing process monthly or annually. The closing entries are the journal entry form of the Statement of Retained Earnings. The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts. Closing entries are posted in the general ledger by transferring all revenue and expense account balances to the income summary account. Then, transfer the balance of the income summary account to the retained earnings account.

Closing all temporary accounts to the retained earnings account is faster than using the income summary account method because it saves a step. There is no need to close temporary accounts to another temporary account (income summary account) in order to then close that again. Temporary accounts are income statement accounts that are used to track accounting activity during an accounting period. For example, the revenues account records the amount of revenues earned during an accounting period—not during the life of the company. We don’t want the 2015 revenue account to show 2014 revenue numbers. If your revenues are less than your expenses, you must credit your income summary account and debit your retained earnings account.